Irr Excel For Mac Formula

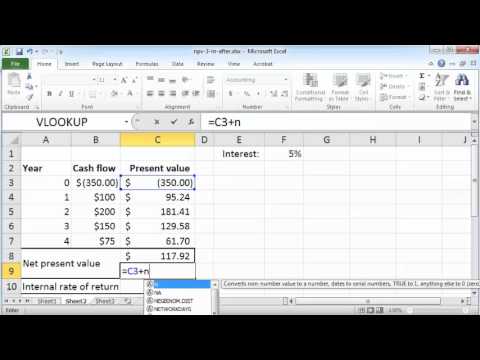

Chapter 16 Using Excel to Determine NPV & IRR Excel contains a number of built-in financial functions. Free android emulator windows 7. Two of these, NPV and IRR, help you calculate the present value of a proposed capital budgeting investment. The time value of money calculations are integrated in the NPV and IRR functions in Excel. Setting up the Spreadsheet with the Cash Flows Excel has two options when using functions. You can skip a data table and type the cash flow amounts directly into the NPV and IRR wizards. Alternatively, you will find that creating a data table streamlines the process when you need to calculate both NPV and IRR for the same data.

A data table allows you to enter the cash flow amounts only once and then cell reference the amounts in the wizard. This Consider the following example to walk through the process of using Excel for capital budgeting problems: Spec, Inc.

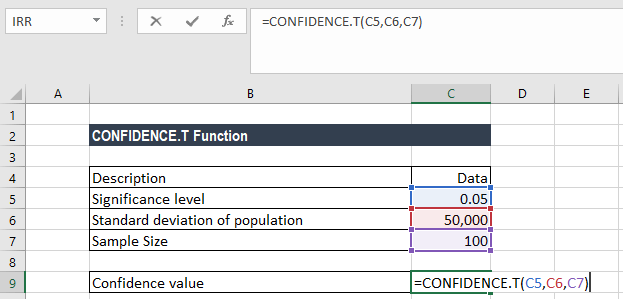

Hello everyone I need to calculate the Internal Rate of Return using the '=IRR()' function. The Problem is that Excel does not find the function and returns the '#.

Is considering the purchase of a machine that costs $60,000 with an estimated salvage value of $12,000. Operating cash flows are estimated to be $15,000 in year 1, $18,000 in year 2 and $21,000 in year 3. The company's cost of capital is 6.22% and its required rate of return is 8.25%. Enter the cash flows in an Excel worksheet by creating a data table in a format similar to the worksheet below: Each operating cash flow amount is assumed to occur at the end of the year. While four columns appear with amounts in them, the time span is for the useful life, a period of three years, with operating cash flows occurring during each of the three years. Calculate NPV.

Step 1: Select the cell in which you want the NPV to appear. From Excel ' s Home menu ribbon, choose Formulas, then choose the Financial functions icon.

Scroll down and select NPV. The NPV Function wizard will appear as shown below. Step 2: By default, the mouse pointer will be flashing in the Rate field. Type the required rate of return in a percentage or decimal format. For example, 8.25% could be entered as a percentage, 8.25% (including the decimal sign) or as a decimal, 0.0825. Note this is a different format than the input in the BAII calculator.

Step 3: Place the mouse pointer in the Value1 field. Select cells C4 to E4.

Alternatively, you can type the cash flow for period 1 into the Value1 field, the cash flow for period 2 in the Value 2, and so on. However, it is much quicker to cell reference the range of cells which contain the cash flows. One word of caution here: Do NOT select the initial cost (B4) as part of the Value1 field in the wizard.

The NPV function only 'discounts' cash flows, and since money paid out today has no interest cost, we do not discount the year 0 cash flow. Step 4: Press OK and Excel will display the amount of the present value of all the future cash flows as $55,233. The NPV formula is displayed in the formula bar as: =NPV(8.25%,C4:E4) Step 5: To calculate the net present value, you must subtract the $60,000 acquisition cost from the present value of the future cash flows. Because the $60,000 is displayed in cell B4 as a negative amount (as a cash outflow), you must add the negative amount. To do this, place your mouse pointer at the end of the NPV formula in the formula bar, and type '+' (plus sign) and the cell reference (B4) of the year 0 cash flow amount. This will add the negative cash outflow that appears in cell A4 to the positive present value amount of $55.233. The modified formula in the formula bar should appear as.

Step 2: By default, the mouse pointer will be flashing in the Values field. Hold down the left mouse button, and select cells B4 to E4.

The IRR function requires that you include all the cash flows, including the cost to acquire for year 0. Step 3: Leave the Guess field blank.

When Excel calculates IRR, it does so by trial and error beginning with 10 percent. If trial and error runs more than about 40 seconds and Excel has not found the correct IRR rate, it will time out. A 'guess' would give Excel a different rate with which to begin to avoid time outs. Click OK and Excel displays the answer as 4.31%.

Be sure to format the cell containing the IRR as a percentage with two decimal places. If your answer appears as 0, you likely have a number formatting error. Since 4.31% is less than the company's required rate of return of 10.3%, you should reject the proposed investment since it will earn less than the company desires as its minimum return.